От 5-летнего планирования

Смотрите в нашем Годовом отчете за 2018 год раздел

Стратегические приоритеты

Стратегические приоритеты

К долгосрочной стратегической концепции на 10 лет

ВЛАДИМИР ПОТАНИН, Президент ПАО «ГМК «Норильский никель»Четкая реализация нашей стратегии в последние шесть лет, а также благоприятные тренды на сырьевых рынках помогли нам обеспечить один из самых высоких в отрасли уровней доходности для акционеров. Теперь пришло время сделать следующий шаг для достижения еще более амбициозных задач как в плане роста бизнеса, так и в плане решения экологических проблем.

ВЛАДИМИР ПОТАНИН, Президент ПАО «ГМК «Норильский никель»Четкая реализация нашей стратегии в последние шесть лет, а также благоприятные тренды на сырьевых рынках помогли нам обеспечить один из самых высоких в отрасли уровней доходности для акционеров. Теперь пришло время сделать следующий шаг для достижения еще более амбициозных задач как в плане роста бизнеса, так и в плане решения экологических проблем.

От соблюдения экологических норм

Смотрите в нашем Годовом отчете за 2018 год раздел

Система экологического менеджмента

Система экологического менеджмента

К комплексной политике по обеспечению «устойчивого будущего» в регионах присутствия компании

Смотрите раздел Экология

МИССИЯ

Эффективно используя природные ресурсы и акционерный капитал, мы обеспечиваем человечество цветными металлами, которые делают мир надежнее и помогают воплощать надежды людей на развитие и технологический прогресс

От поставщика ресурсов

К движущей силе глобального перехода на экологически чистый транспорт

ОСНОВНЫЕ ТЕНДЕНЦИИ НА РЫНКЕ ПАЛЛАДИЯ

2019 год: очередной год роста котировок палладия, связанный с устойчивым увеличением потребления в автомобильной промышленности на фоне ужесточения экологических стандартов по всему миру. Дефицит был компенсирован за счет роста первичного производства и увеличения сбора ломов автомобильных катализаторов, тогда как поставки из ранее накопленных запасов значительно сократились.

Подробнее в разделе Обзор рынка металлов

К распределению капитала обеспечивающему рост при сохранении лидирующих в отрасли показателей

Смотрите раздел Основные инвестиционные проекты

Важнейший вклад в глобальную повестку устойчивого развития: поддержание перехода на экологически чистый транспорт

Смотрите раздел Комплексная экологическая программа

К 2030 году компания сможет поставлять на мировой рынок объемы МПГ, достаточные для производства

автокатализаторов

Рост производства высококачественного никеля позволит изготавливать

аккумуляторных блоков для электромобилей

«Норникель» является ведущей компанией в российской горно-металлургической отрасли и крупнейшим мировым производителем палладия и высокосортного никеля, а также крупным производителем платины и меди. «Норникель» также производит кобальт, родий, серебро, золото, иридий, рутений, селен, теллур и серу.

ДЛЯ ЧЕГО МЫ

ЭТО ДЕЛАЕМ

ЭТО ДЕЛАЕМ

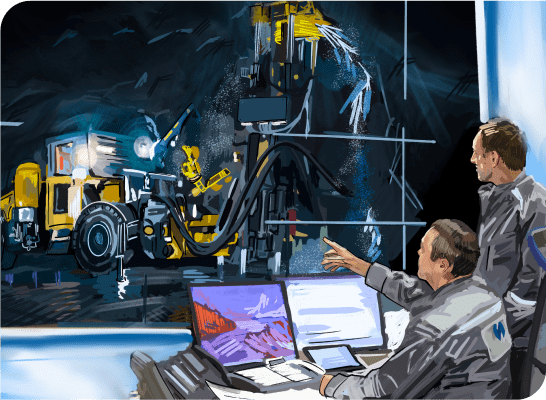

Смотрите наш кейс Техпрорыв

Смотрите наш кейс Цифровая лаборатория

Смотрите наш кейс Follow Up Siberia